Forest Stewardship Incentive Programs: How Can We Interest More Landowners?

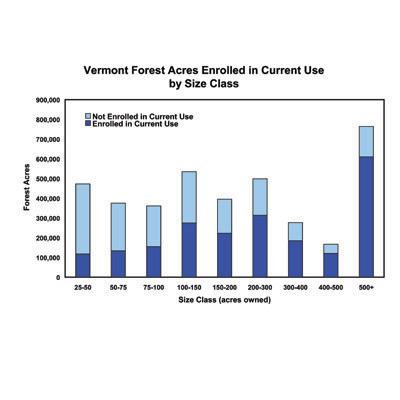

Vermont’s Current Use taxation program was designed to keep property taxes on enrolled forest land compatible with the productive capacity, or current use, of the land. While this program and others have been successful in reaching some landowners, many landowners do not take advantage of existing options. For example, nearly half of the land potentially eligible for Vermont’s Current Use program was not enrolled in 2006. Failure to engage citizens or understand their forest management strategies and concerns constitutes a serious challenge to the sustainable future of the Northern Forest and its communities.

To understand more about landowners who are not taking advantage of Vermont’s Current Use program or other stewardship help available to them, NSRC researchers surveyed eligible Addison and Essex County landowners not enrolled in 2005, followed by a focus group in each county to obtain more in-depth landowner responses. Analysis of 2006 Vermont tax data provided background information.

Survey results revealed a consistent group of landowners who had concerns about their land but were not connecting with existing programs, mainly because they did not want to give government or an organization authority over land management decisions. Other concerns included complexity of written program information, costs of management plans and penalties for withdrawal of properties, and incorrect information provided at the town level. Recognizing the financial needs of landowners who have few assets other than their land, providing financial expertise, and establishing programs to buy easements or forest land when owners need to sell would address some of the unmet needs of forest landowners.

Download printable version [PDF]

Download full final report [PDF]